Sub-Saharan Africa’s Missing Middle for Agri-finance: Challenges and Solutions

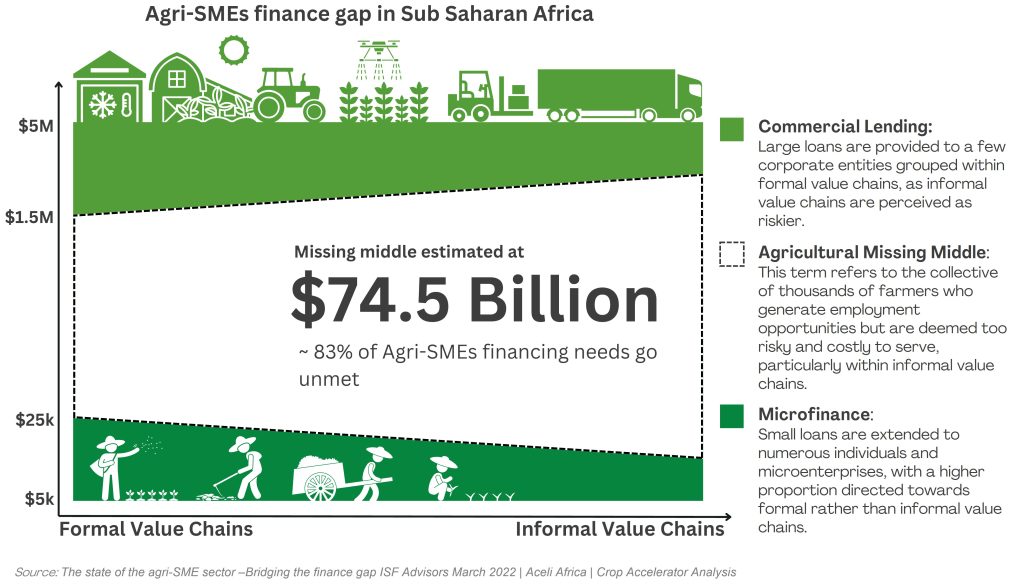

In recent years, agricultural lending in Sub-Saharan Africa has grown steadily. However, the region still faces a significant challenge known as the “missing middle” in agri-finance. This is partly due to investors’ perception that the segment is too risky and costly.

Funding in the agri-finance sector often favors a few big corporate entities in formal value chains or microfinance institutions offering small loans to individuals and microenterprises. Consequently, many small and medium-sized agricultural businesses (Agri-SMEs) are usually unable to access financing.

Agri Finance for SMEs – principal sources of funding

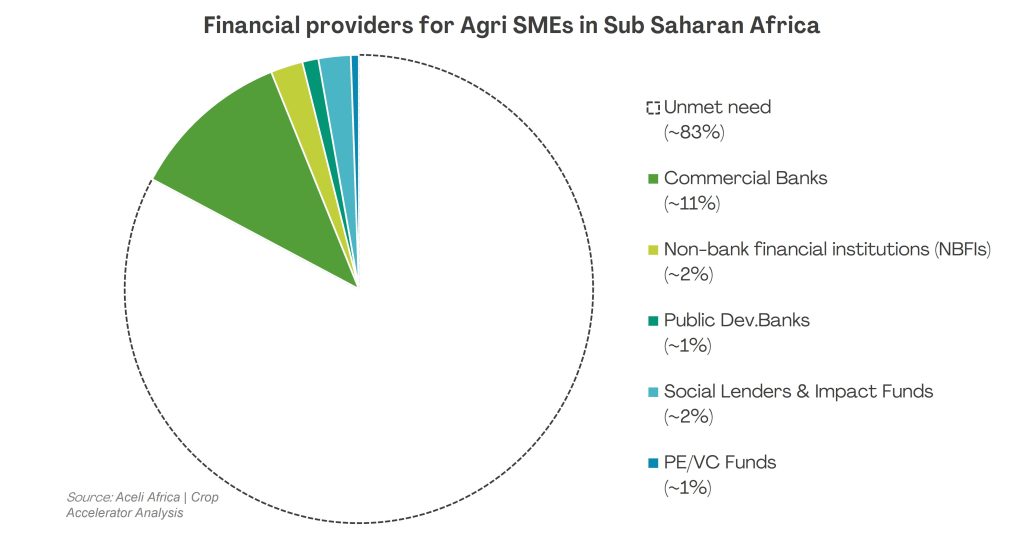

Sub-Saharan Africa has around 130,000 Agri-SMEs, which are crucial for agricultural productivity and rural development. Yet, they encounter substantial financial hurdles. These Agri-SMEs demand approximately USD 90 billion annually.

About 83% of these needs go unmet, totaling USD 74.5 billion annually, underscoring the urgent need for innovative solutions.

Financial providers for Agri SMEs

The major sources of funding include:

- Local commercial banks (~65% of current funding)

Local commercial banks provide the bulk of current funding through traditional debt funding products such as working capital, trade finance, and asset finance.

East Africa has more advanced commercial banks specialized in agriculture than the rest of Sub-Saharan Africa. These banks offer innovative products not available at general commercial banks.

However, banks usually lend to the most creditworthy borrowers with a track record and collateral, mainly focusing on urban areas. This leaves gaps in financing for rural agri-SMEs.

- NBFIs (Non-bank financial institutions) (~13% of current funding)

NBFIs are typically smaller than banks or investment funds and focus on specific product offerings or borrower segments, such as asset leasing or short-term credit lines. NBFIs usually deal with smaller loan sizes because they lack the capacity to handle larger loans, and their financial products have limitations.

However, while NBFIs hold promise for increasing access to finance, their high capital costs often restrict their widespread adoption across Sub-Saharan Africa.

- Public development banks (~6% of current funding)

Public development banks are government-owned financial institutions. They play a major role in not just direct lending to agri-SMEs but also in providing catalyzing options to private-sector lenders, such as credit guarantees.

However, they typically prioritize broader sectors or government projects rather than SMEs.

- Impact-oriented funds and social lenders (~13% of current funding)

Impact-oriented funds and social lenders are vital in filling financing gaps left by larger banks. While 57% of these funds allocate some resources to food and agriculture, they represent only around 9% of global assets under management.

These funds often possess significant agricultural expertise and offer appropriate lending terms. They also have access to lower-cost, impact-focused capital. However, they may have a limited presence in countries where they operate, which can affect their ability to service loans efficiently.

They typically operate by lending in hard currency (USD, EUR, GBP,JPY) which is funded by international donors. As a result, they tend to prioritize funding for enterprises involved in export-oriented value chains, like producer groups or traders/processors in coffee, cocoa, or other export products. Some funds may also target smaller or earlier-stage agri-SMEs with a significant social and environmental impact.

- Private equity and venture capital (~3% of current funding)

Private equity and venture capital funds contribute just USD 1 billion in equity financing to agri-SMEs despite the pressing need for capital. This funding targets private companies at specific stages of development, offering appealing risk-adjusted returns. However, their contribution is minimal compared to larger, more localized channels like commercial banks.

This limited contribution is because of a mismatch between return expectations, investment sizes, and timeframes with the readiness, scale, and willingness of agri-SME owners to involve external investors. Private equity and venture capital funds typically demand high management and governance standards, along with extensive reporting on environmental, social, and governance metrics. They prefer large deals and high-growth potential, with investment sizes often exceeding what most agri-SMEs can handle.

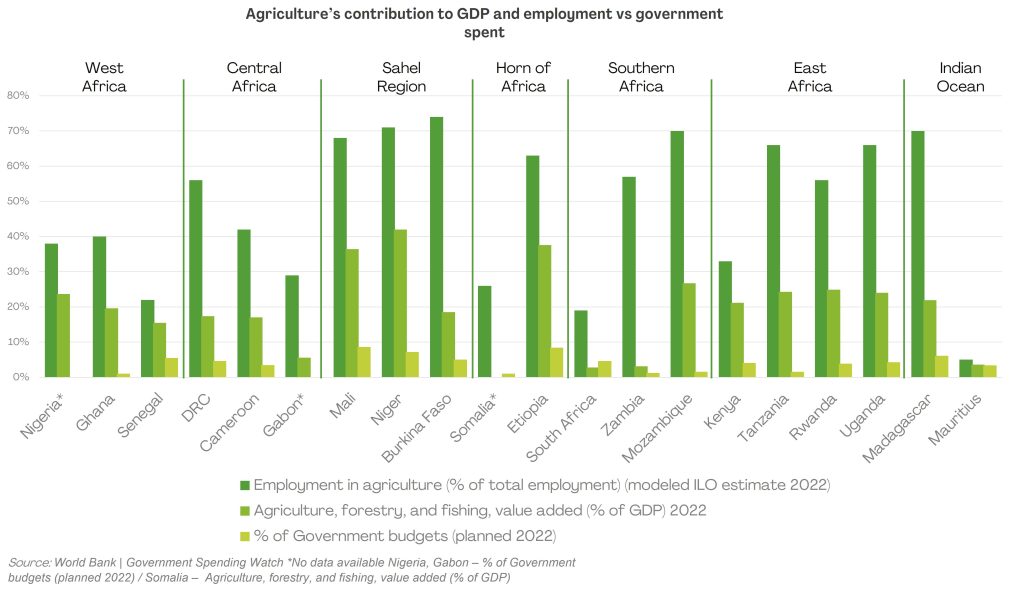

- Local governments

African governments invest less than 10% of their budgets in agriculture, and in most countries, many direct less than 5% of total budgets towards the agricultural sector (with a big chunk of it being donor-funded). This glaring disparity highlights a critical need for transformative action to unlock the full potential of African agriculture.

The importance of agriculture

At the same time, agriculture sustains over 60% of the region’s population and has long been the backbone of the local economies. However, despite its pivotal role, the sector receives a disproportionately low share of government spending and estimated less than 5% of the overall commercial lending portfolio, slowing down its development and limiting its contributions towards achieving the Sustainable Development Goals (SDGs).

Key challenges driving the financing gap for Agri SMEs and potential approaches.

Key challenges for lenders

- Comparatively high risk and low returns: Lending to agri-SMEs often involves higher risks due to market volatility, weather uncertainties, and limited access to collateral. Additionally, the returns from lending to agri-SMEs may be lower than those of other sectors. Lenders try to reduce risk by setting strict rules and collateral, which means many SMEs and specific markets can’t get loans. Still, even with these rules, lenders often face high losses because some borrowers can’t repay their loans.

- Impact risks: Agri-SME lending may face risks related to its impact on environmental and social factors. Ensuring sustainable practices and positive social outcomes while maintaining profitability can be challenging.

- Early-Stage Risks: Many agri-SMEs are in their early stages of development, making them riskier investments for lenders. These businesses may need a proven track record, making it difficult to assess their creditworthiness accurately.

- Scalability Risks: Agri-SME lending may face challenges in scaling operations due to limited infrastructure, market fragmentation, and regulatory constraints (among others).

- Manager Risk: The success of agri-SMEs often depends on the competence and experience of their management teams. Lenders face risks if the management team lacks the necessary skills or if there is a high turnover rate.

- Liquidity Risk: Agri-SME lending may involve longer repayment periods and illiquid collateral, leading to liquidity risks for lenders.

- Exit Risk: Exiting investments in agri-SMEs, notably equity investments, can be challenging due to limited exit options and the illiquid nature of agricultural assets.

- Project sourcing: Identifying viable agri-SME projects that meet the lender’s criteria can be difficult, particularly in remote or underserved areas.

- Cost of due diligence: Conducting thorough due diligence on agri-SME borrowers can be costly and time-consuming, especially for smaller loan sizes. Serving small agricultural businesses efficiently and profitably is challenging. The economics of lending favour larger loans. Because of this, lenders often avoid providing loans to smaller businesses that could grow and benefit from financing.

Further reading

Agricultural Insurance and Risk Management

8 Key Approaches for Risk Mitigation for Agri SMEs to Attract Financing

Cocoa Farmers’ Livelihood Challenges in West African

South African Government Initiatives and Support for Sustainable Agricultural Practices

Strategies for Small-Scale Farmers in Tropical Africa to Adapt to Climate Change